Investing in the stock market can be a rewarding venture, but there are times when the market does not perform as expected. In these situations, investors may consider betting against the stock market, a strategy known as short selling. This article explores three simple strategies for betting against the stock market, providing insights into how you can navigate this approach effectively.

Understanding Short Selling

Short selling involves borrowing shares of a stock from a broker and selling them at the current market price, with the expectation that the price will decline. When the price drops, the investor can buy back the shares at the lower price, return them to the broker, and pocket the difference. This strategy carries significant risks, as potential losses are theoretically unlimited if the stock price rises instead.

Using Put Options

Put options are financial contracts that give the holder the right to sell a stock at a predetermined price within a specific timeframe. By purchasing put options, investors can profit from a decline in a stock’s price without needing to borrow shares. This strategy allows for limited risk, as the maximum loss is limited to the premium paid for the option.

Inverse Exchange-Traded Funds

Inverse Exchange-Traded Funds (ETFs) are designed to move in the opposite direction of a specific index. When the index declines, the value of the inverse ETF increases. These funds provide a straightforward way for investors to bet against the market without the complexities of short selling. They are suitable for both short-term trading and longer-term bearish positions.

Market Hedging

Hedging is a risk management strategy that involves taking an offsetting position in a related asset to reduce potential losses. Investors can hedge their stock portfolio by investing in assets that typically perform well during market downturns, such as bonds or gold. This approach minimizes risk and can help protect against significant losses during market declines.

Utilizing Technical Analysis

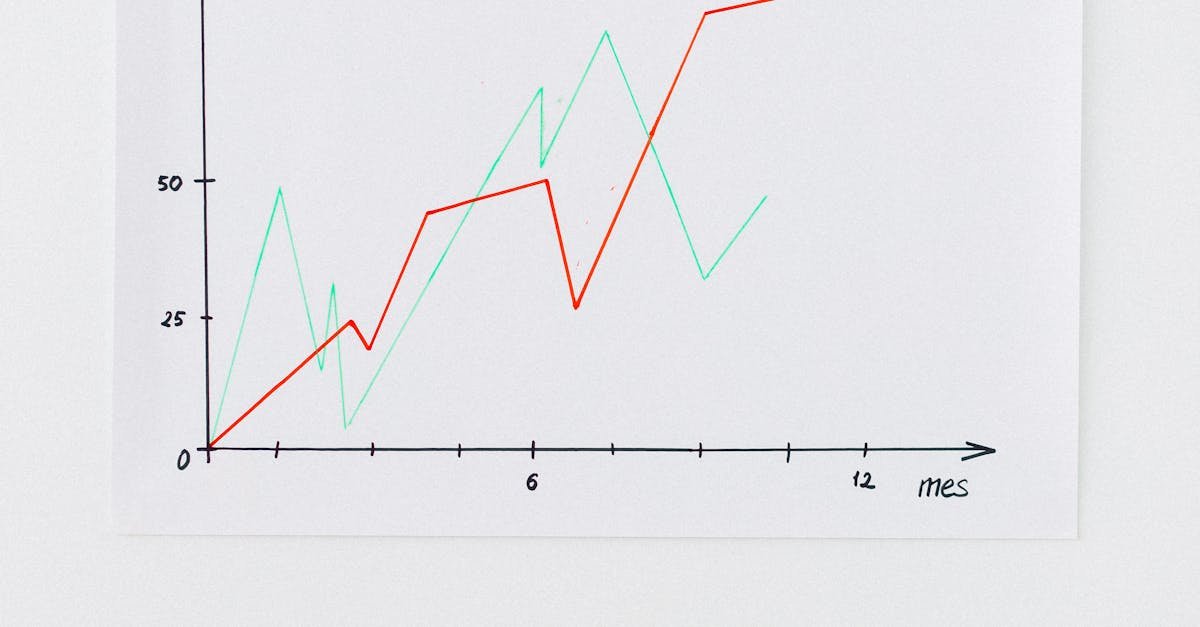

Technical analysis involves analyzing price charts and market trends to predict future price movements. Investors can use this analysis to identify potential reversal points in the market. By recognizing patterns that indicate a stock or market may be overbought, investors can time their short positions more effectively, increasing the likelihood of profitable trades.

Staying Informed About Market News

Keeping abreast of economic indicators, corporate earnings reports, and geopolitical events is crucial for investors looking to bet against the market. Negative news can lead to market declines, and being aware of potential catalysts can help investors make informed decisions. Staying informed allows for timely actions that can capitalize on bearish market conditions.

Implementing Risk Management Strategies

Risk management is essential when betting against the stock market. Investors should set stop-loss orders to limit potential losses and consider the size of their positions relative to their overall portfolio. Diversifying investments and being prepared for market volatility can help manage risks associated with bearish bets.

| Strategy | Risk Level | Time Horizon | Complexity |

| Short Selling | High | Short-term | High |

| Put Options | Moderate | Short to Medium-term | Moderate |

| Inverse ETFs | Low to Moderate | Short to Long-term | Low |

| Market Hedging | Low | Long-term | Moderate |

| Technical Analysis | Moderate | Short to Medium-term | High |

| Market News | Low | Varied | Low |

| Risk Management | Varied | Ongoing | Moderate |

Betting against the stock market can be a strategic way to profit during downturns, but it is essential to understand the risks involved. By utilizing strategies such as short selling, put options, inverse ETFs, and effective risk management, investors can navigate bearish markets with confidence.

FAQs

What is short selling, and how does it work?

Short selling involves borrowing shares of a stock, selling them, and then buying them back later at a lower price to return to the lender. It profits from a decline in the stock’s price.

Are put options risky?

Put options carry risks, but they are generally considered less risky than short selling since the maximum loss is limited to the premium paid for the option.

What are inverse ETFs?

Inverse ETFs are funds designed to move in the opposite direction of a specific index, allowing investors to profit from market declines without short selling.

How can I manage risks when betting against the stock market?

Investors can manage risks by using stop-loss orders, diversifying their portfolio, and staying informed about market conditions to make timely decisions.